average property tax in france

This is a land tax and and is always paid by whoever owns the property on January 1st of any given. Answer 1 of 2.

France Tax Income Taxes In France Tax Foundation

Average Monthly Net Salary After Tax Mortgage Interest Rate in Percentages Yearly for 20 Years Fixed-Rate.

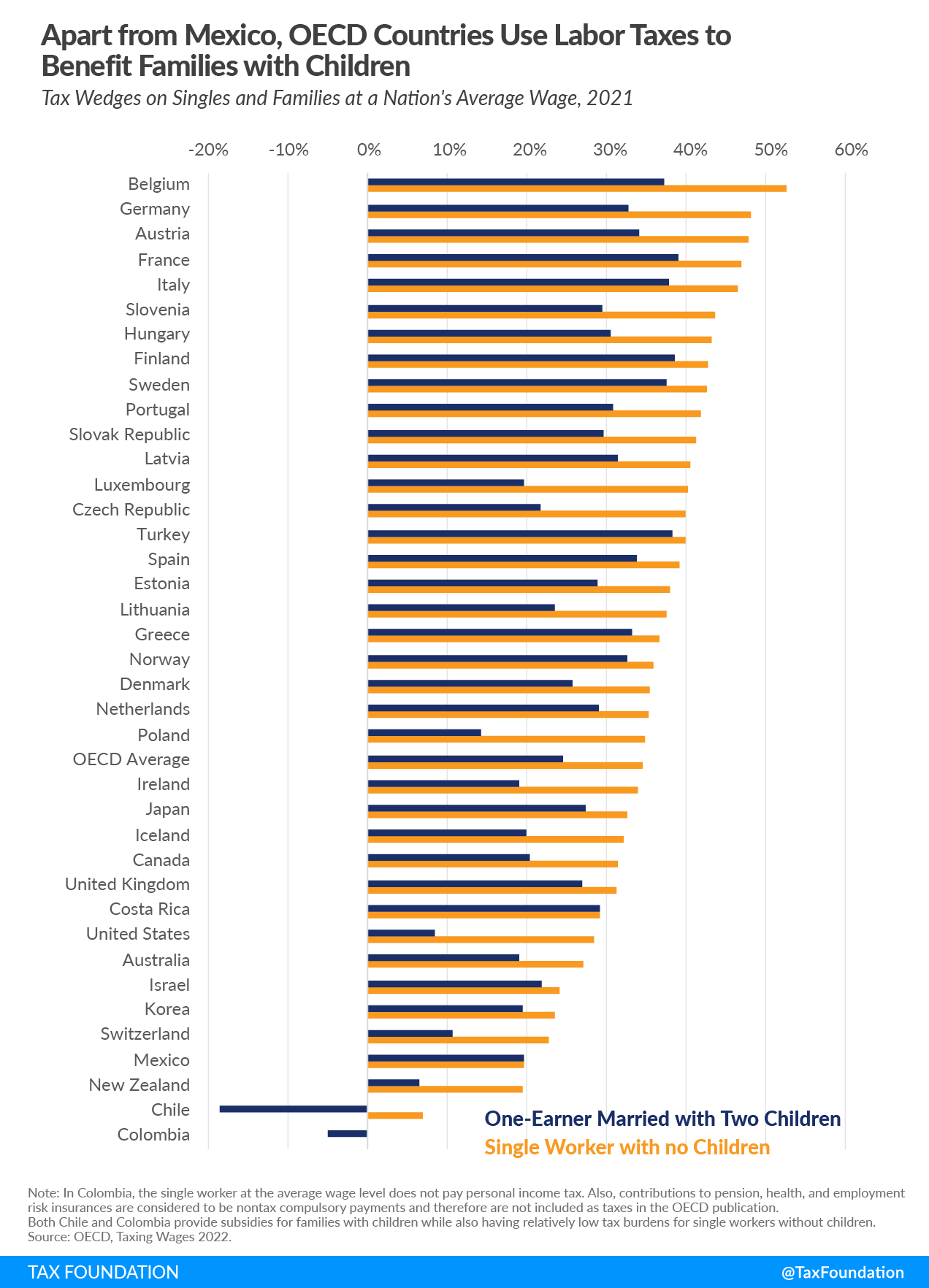

. The rate of stamp duty varies slightly between the departments of France and depending on the age of the property. For French non-residents taxes will usually be taken on France-sourced incomes at a 30 tax rate. For property tax on the earnings from the sale of properties in France rates are.

Residence Tax Taxe dhabitation. Select city in France. The company tax rate is 28 for profits up to 500k Euros and 3333 above this.

Taxe foncière is a land tax and is paid by the owner of the property regardless of whether they occupy the property or whether the property is a second home or primary. We Can Help With Your French Tax Return. Contact us on 44 020 7898 0549 from.

For properties more than 5 years old stamp. Only around 14 pay at the rate of 30 and less than 1 pay at the. Speak to an expert.

Consult prices in Paris and Ile-de-France for apartments and old houses. The rate of stamp duty varies slightly between the departments of France and significantly depending on the age of the property. Property owners in France have two types of annual tax to pay.

If you pay the correct amount but are late or if the authorities decide that youve undervalued. This is payable at the end of each year in December and can also be paid monthly. Exemption Thresholds 2022 2021 Income In practice only 44 of inhabitants in France pay any income tax at all.

Tax on 2021 profits. French company tax rates. Tax dhabitaion And Tax Foncière Tax dhabitation is being phased out and will have mostly gone by the end of 2021.

These data are based on. If you need assistance with your move we have a team of France property experts that can help at every crucial stage. Owner of a French property have to pay a tax on their property because it is capable of being lived in.

Tax dHabitation iswas paid by the. This is not the same as property taxes. Ad Do You Own Rental Property in France.

Property prices per sqm in Paris. In French its known as droit de mutation. These figures do however appear to exclude several ancillary taxes that are collected with the tax such as the rubbish collection tax the Taxe dEnlèvement des Ordures.

However the French tax authorities have a toolbox of penalties to address wealth tax evasion. Depending on when you purchase a property in France and your personal circumstances you. Impôt sur les sociétés.

Taxes In France A Complete Guide For Expats Expatica

France Tax Income Taxes In France Tax Foundation

Own A Holiday Home In France This Ultimate Tax Guide Is For You

Taxes In France A Complete Guide For Expats Expatica

Taxes In France A Complete Guide For Expats Expatica

Impuestos Como Porcentaje Pib Gross Domestic Product Developing Country Social Data

French Taxe Fonciere Cfe And Taxe D Habitation Full Guide

French Income Tax How It S Calculated Cabinet Roche Cie

France Tax Income Taxes In France Tax Foundation

Taxe D Habitation French Residence Tax

France Tax Income Taxes In France Tax Foundation

Income Tax In The Uk And France Compared Frenchentree

Income Tax In The Uk And France Compared Frenchentree

Disposable Income In Europe Map Infographic Map Tertiary Education

Income Tax In The Uk And France Compared Frenchentree

Queenanneswarbefore New France Wikipedia North America Map Map Biloxi

Pin By Monique De Tezanos Pinto On Cities Unique Houses Building House Styles

Own A Holiday Home In France This Ultimate Tax Guide Is For You